Large Cap Strategy

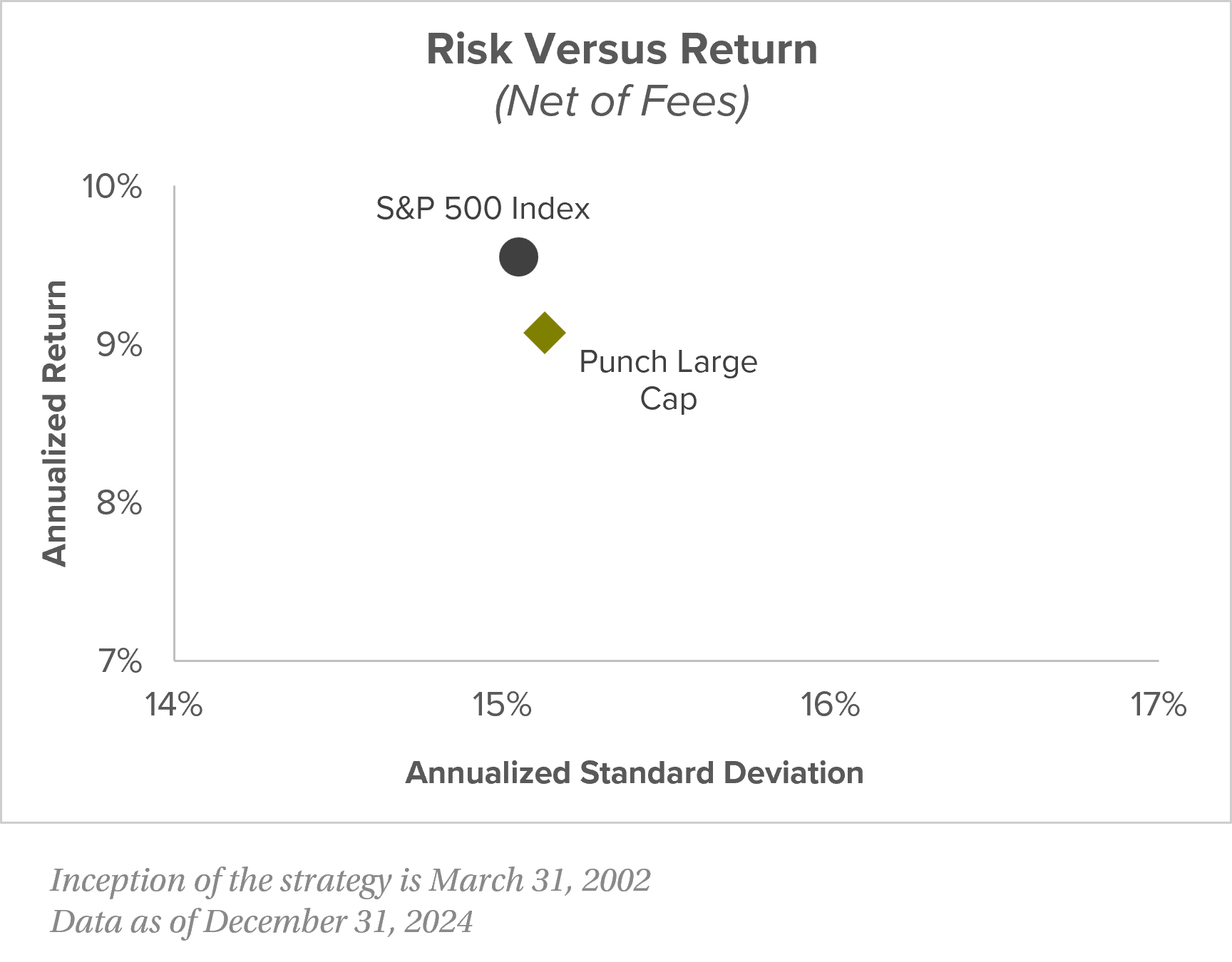

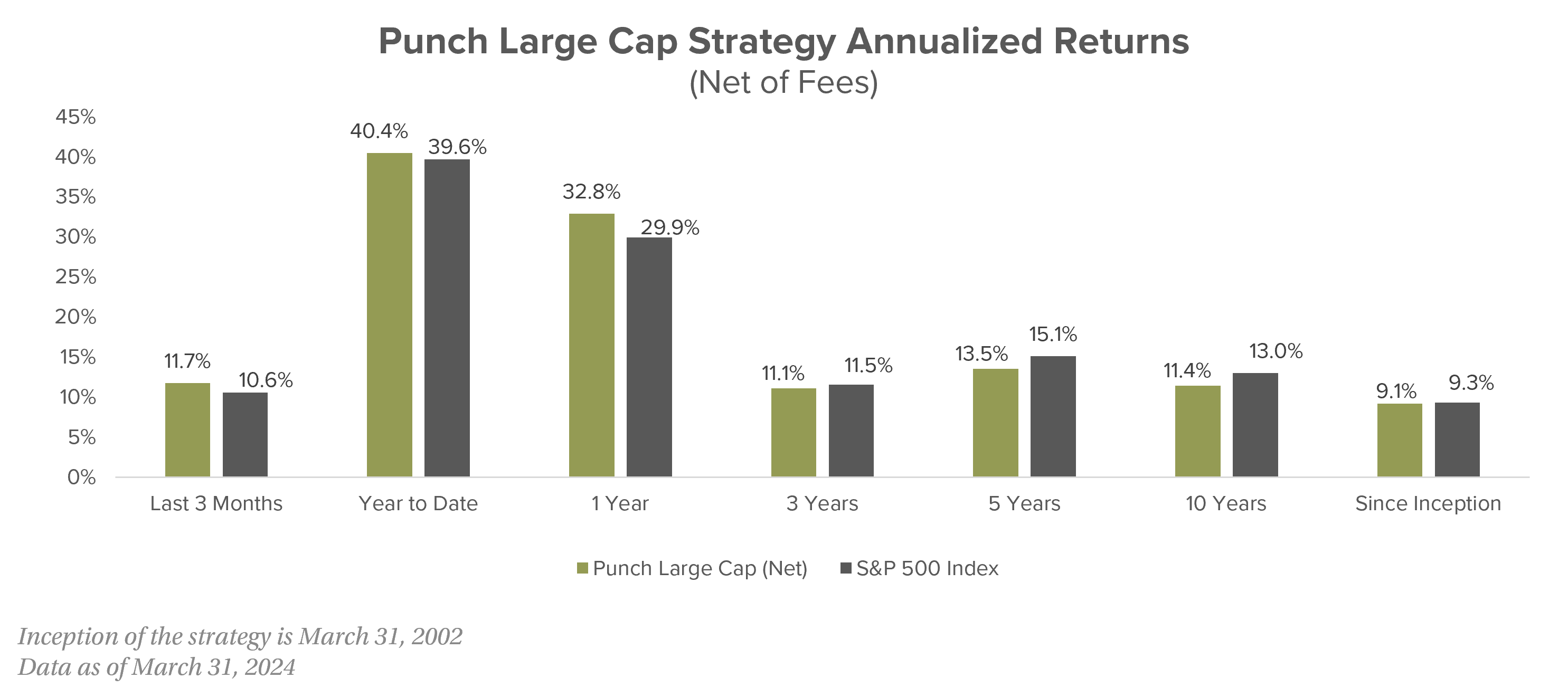

The Punch Large Cap Strategy is a concentrated portfolio owning approximately 30 large cap companies.

The strategy invests in individual stocks with market capitalizations generally over $5 billion. The focus is long-term capital appreciation.

- We apply the firm’s investment philosophy guided by the principles of behavioral finance to purchase higher quality, competitively advantaged companies at what we believe are attractive prices.

- Our intention is to own companies capable of growing their earnings and cash flow over multi-year periods.

- We apply a low turnover approach to portfolio management so the Large Cap Strategy can benefit from the growth of our companies’ earnings.

The Punch Large Cap Strategy is designed to provide broad, U.S. large-cap equity exposure. We believe our success has been driven by our careful stock-picking and low-turnover approach in an asset class where information is abundant.

Punch & Associates Investment Management, Inc. All rights reserved.