Income Strategy

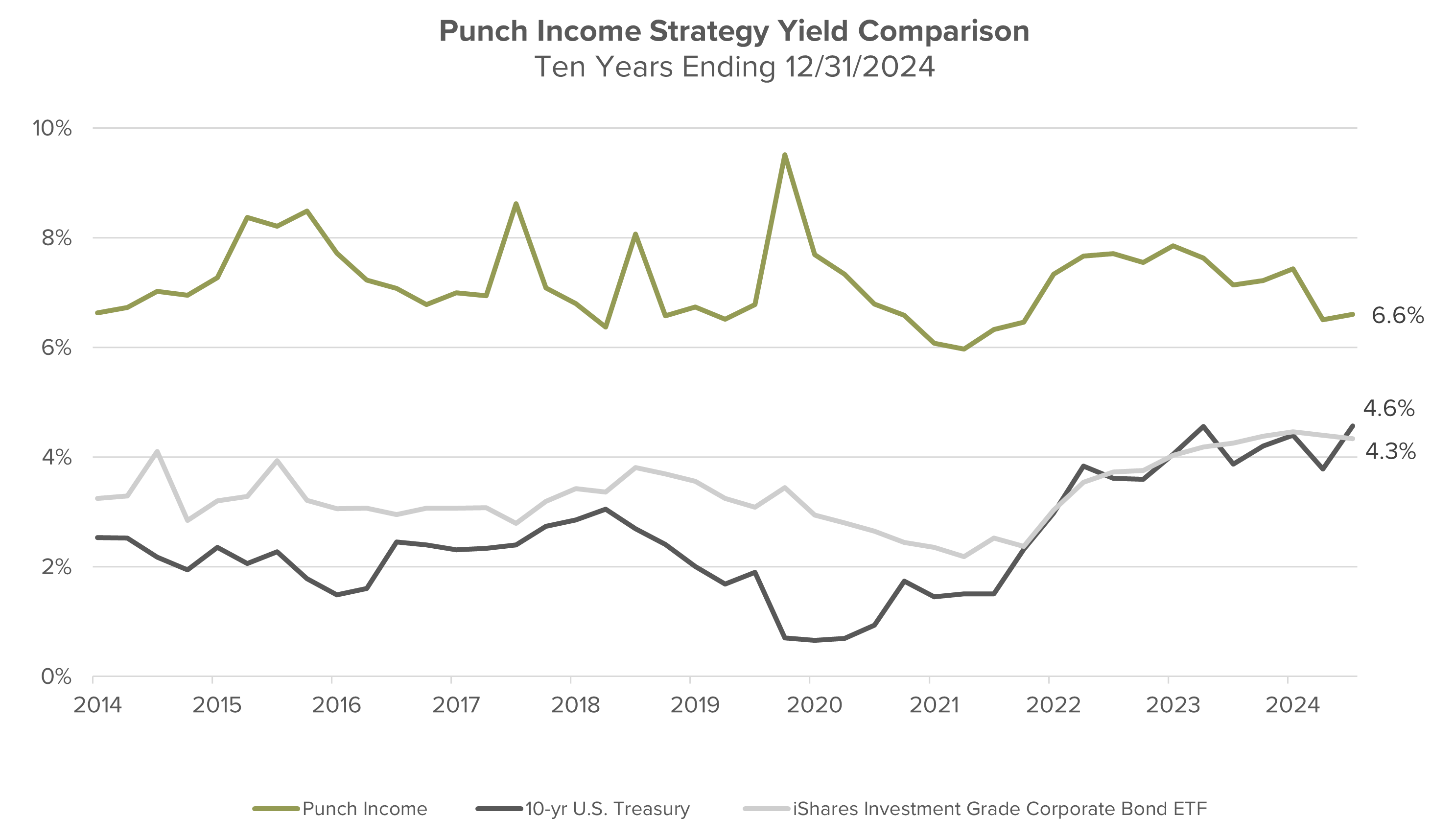

Financial markets may go through extended periods of time where the majority of the return offered is from dividends as opposed to capital appreciation.

We apply careful analysis to identify under-researched opportunities which generate predictable current income and have the potential for long-term capital appreciation. Maintaining a focus on value, we buy securities that have sustainable and durable income streams. We take an opportunistic and active approach which seeks to take advantage of extreme investor behavior and exaggerated price movements.

- We incorporate a large number of asset classes and maintain the flexibility to overweight or underweight each one as necessary.

- We designed the strategy to generate regular and predictable income regardless of the prevailing market environment.

- We insist on regular cash flows and take a “reversion to the mean” approach to asset allocation.

Holdings included in the portfolio:

- Closed-end funds

- Preferred stocks

- Utilities

- Real Estate Investment Trusts

-

Corporate bonds

-

Municipal bonds

-

Treasury bonds

-

Common stocks

The Income Strategy's primary objective is to generate predictable current income with the secondary objective of long-term capital appreciation. We believe that the strategy's success has been realized through the flexibility to invest in a variety of asset classes depending on where we find quality, yield-oriented securities.

Punch & Associates Investment Management, Inc. All rights reserved.