Small Cap Equity Strategy

Contrarian, Value-oriented,

Risk-averse, Research-driven

Process

Our investment process begins by simply observing other investors' behavior. What areas of the market are others ignoring, avoiding or misunderstanding? Where are these behaviors potentially creating value?

Once an area of opportunity is identified, the hard work of research begins. There are no shortcuts or quick fixes. Our team of research enthusiasts rolls up their sleeves everyday - reading, traveling, conducting hundreds of phone calls and interviews - all in the hope of uncovering a single idea worthy of our portfolio. We are patient, risk-averse investors who do an inordinate amount of homework, and we wait for hard work to pay off over time.

Our process is highly collaborative and team-oriented. The investment team - every analyst, portfolio manager and trader - sits together at a large trading desk where ideas and conversations flow freely. There are no specialists on our team - only generalists - and everyone's task is the same: identify compelling opportunities, and then research them assiduously.

Portfolio

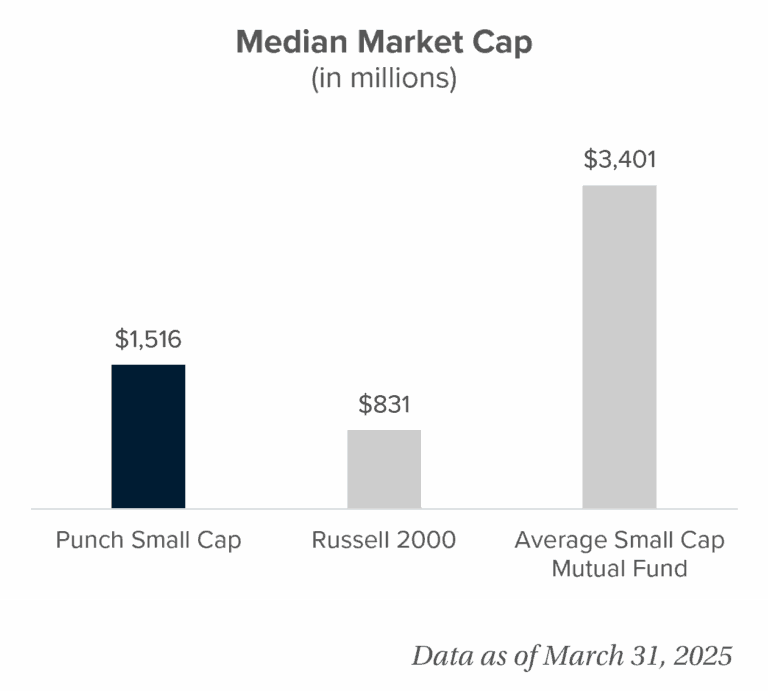

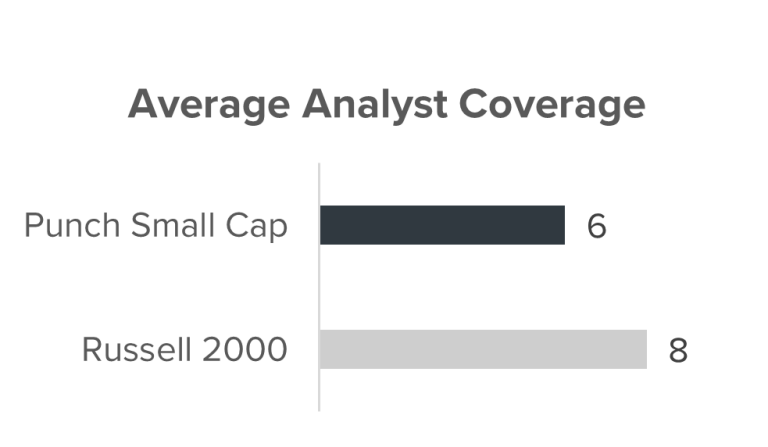

We take a fundamental, bottoms-up approach to building a concentrated portfolio of small cap companies that we believe are under-recognized and under-valued. We intend to own companies for a period of years, not months. While we are "benchmark-aware," we don't manage to the benchmark; our high active share reflects this approach. We take pride in building an original portfolio in our search for contrarian, value-oriented investment ideas.

Performance

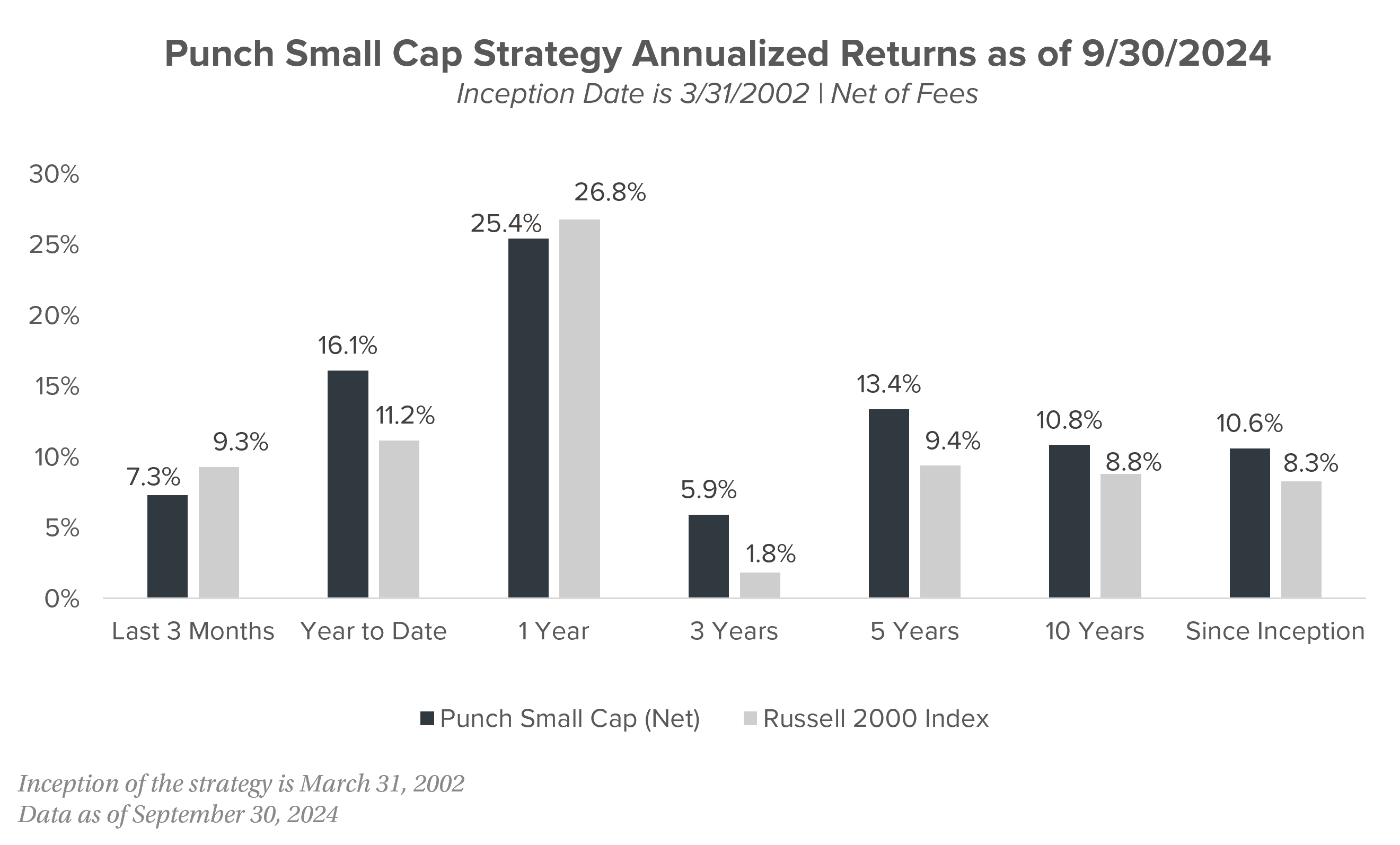

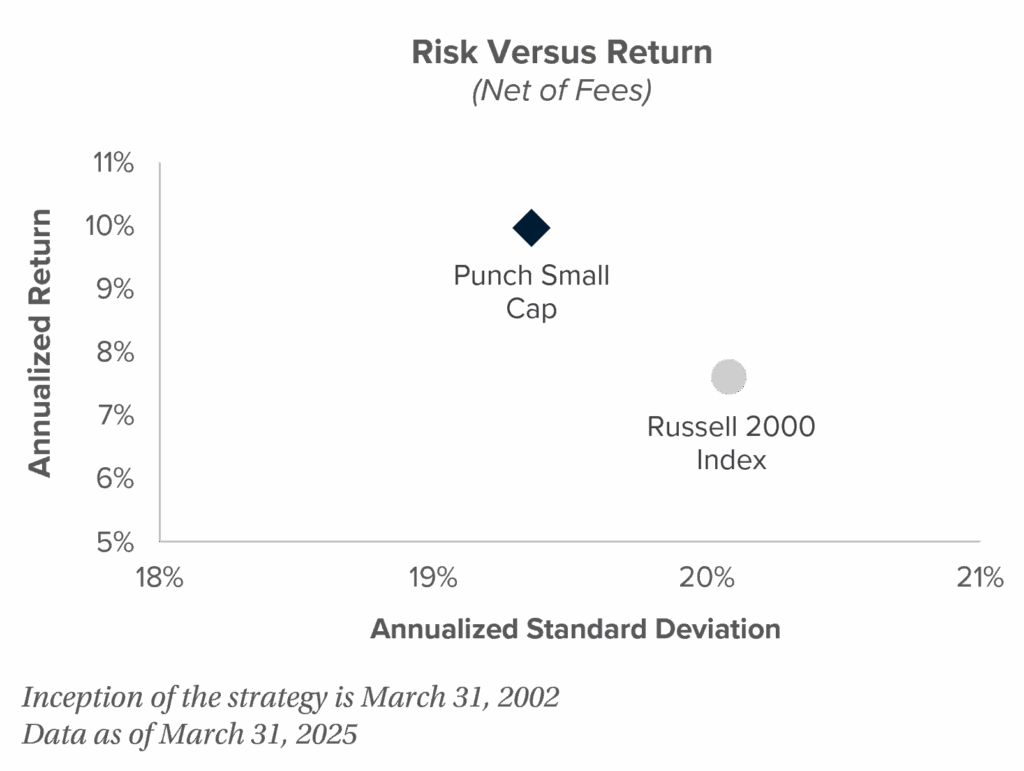

Since its inception, the Small Cap Strategy has outperformed the Russell 2000 Index while also enduring lower levels of volatility. We believe this is not only indicative of the validity of our philosophy and process, but also a combination of intuition and detailed diligence.

Up-capture and Down-capture statistics are also reflective of our philosophy's value orientation and risk-aversion.

| Up-Capture* | 98.78% |

| Down-Capture* | 88.98% |

| Annualized Alpha | 2.75% |

*Up & Down Capture: A statistical measure of an investment manager's overall performance in up or down markets. The up-market capture ratio is used to evaluate how well an investment manager performed relative to an index during periods when that index has risen while down-capture ratio applies during periods when the market has fallen. The ratio is calculated by dividing the manager's net of fee returns by the returns of the index during the respective up-market or down market months and multiplying that factor by 100.

Portfolio Managers

Howard Punch

Chief Investment Officer

Howard directs all research and investment initiatives at Punch & Associates. Starting his career in the early '80s at Merrill Lynch in New York City and then as a retail guy in Minneapolis, it was normal practice to call clients with one stock at a time, state the case for owning it and hope for the best.

John Carraux, CFA

Managing Partner & Portfolio Manager

John is intimately involved in all aspects of the research and investment process at Punch & Associates, and he works closely with our team to manage our investment strategies on a daily basis.

Punch & Associates Investment Management, Inc. - All Rights Reserved